Irrevocable Living Trust Arizona

Arizona irrevocable living trust form.

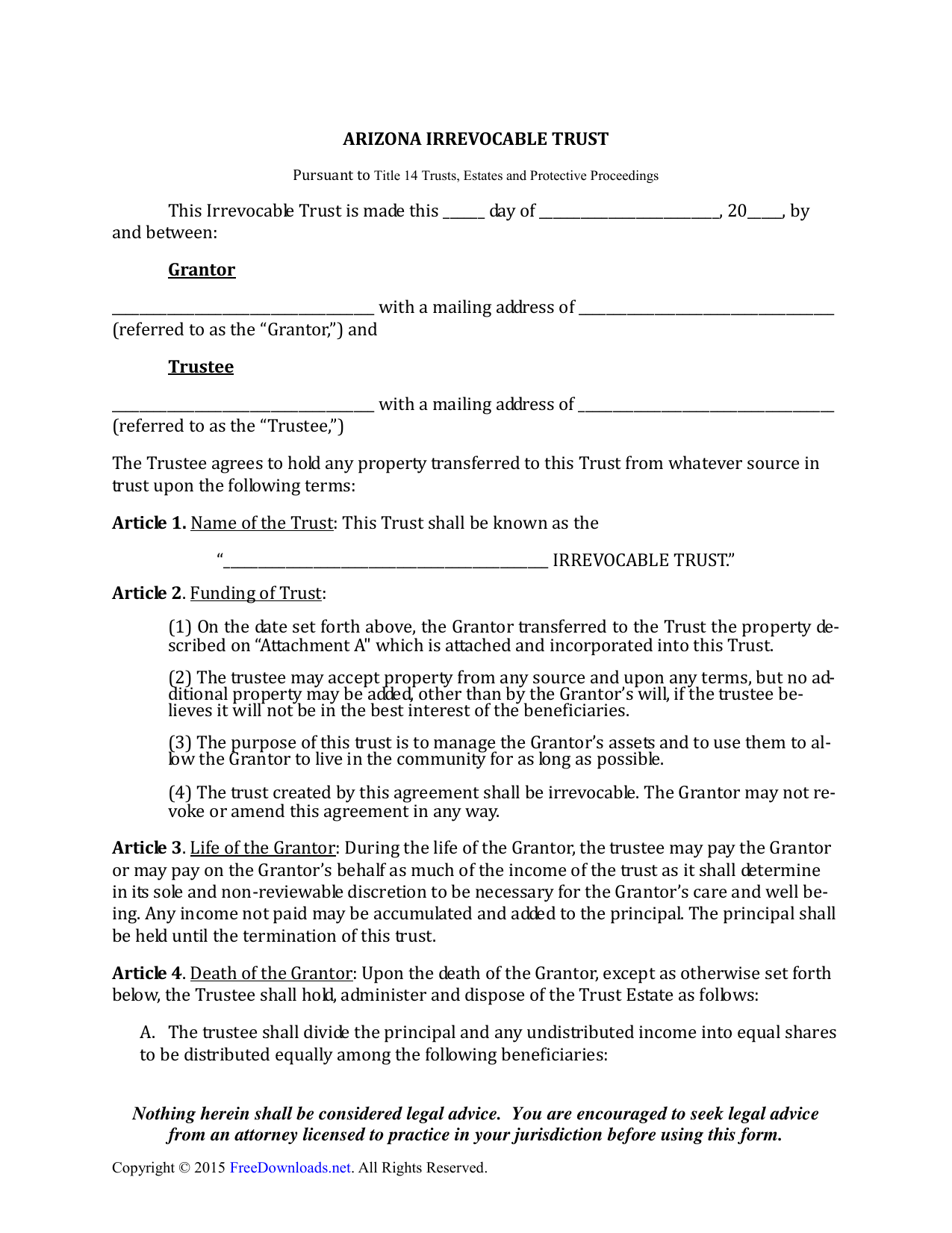

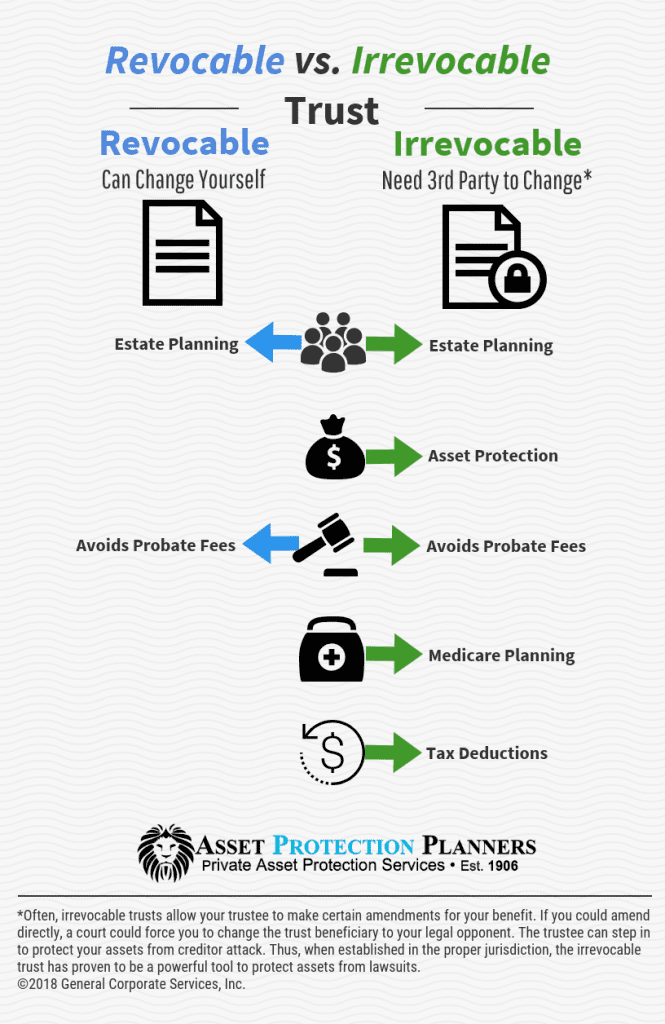

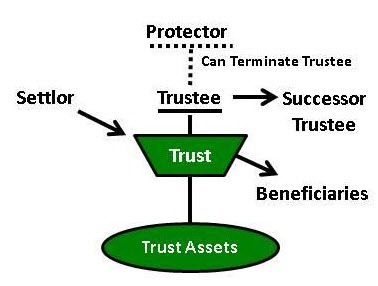

Irrevocable living trust arizona. Creating a living trust in arizona allow you to pass on your assets without having to go through the probate process. Download the arizona irrevocable living trust form which allows you as the grantor to transfer your property into a new entity called an irrevocable trust. This trust is administered by a trustee who is obligated to take care of the property with the best interests of those who are designated to receive the property in mind. Assets held in a revocable living trust are also within reach of creditors and lawsuits.

This trust is administered by a trustee adobe pdf. Generally it is extremely difficult if not impossible to alter an irrevocable trust. While the code went into effect january 1 2009 many people are still unaware of the significant changes and the requirements it imposes on irrevocable trusts. If you have an irrevocable trust or are a beneficiary of an irrevocable trust you should be aware of important provisions contained in the arizona trust code.

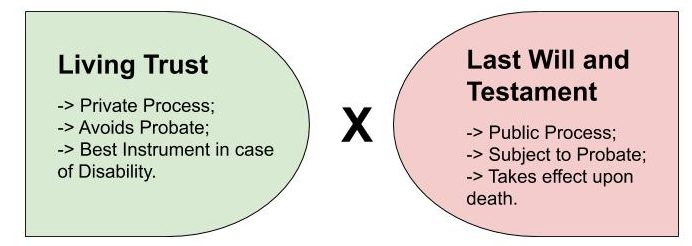

Unlike a will the contents of a living trust don t have to be distributed in probate and are not made public record. Some irrevocable trusts include clauses that allow modifications to be made at the discretion of the beneficiary see ars 14 10411 for arizona but only if the proper clauses were included in the trust documents. Although arizona uses the uniform probate code a trust allows a speedy. Download the arizona irrevocable living trust form which allows you as the grantor to transfer your property into a new entity called an irrevocable trust.

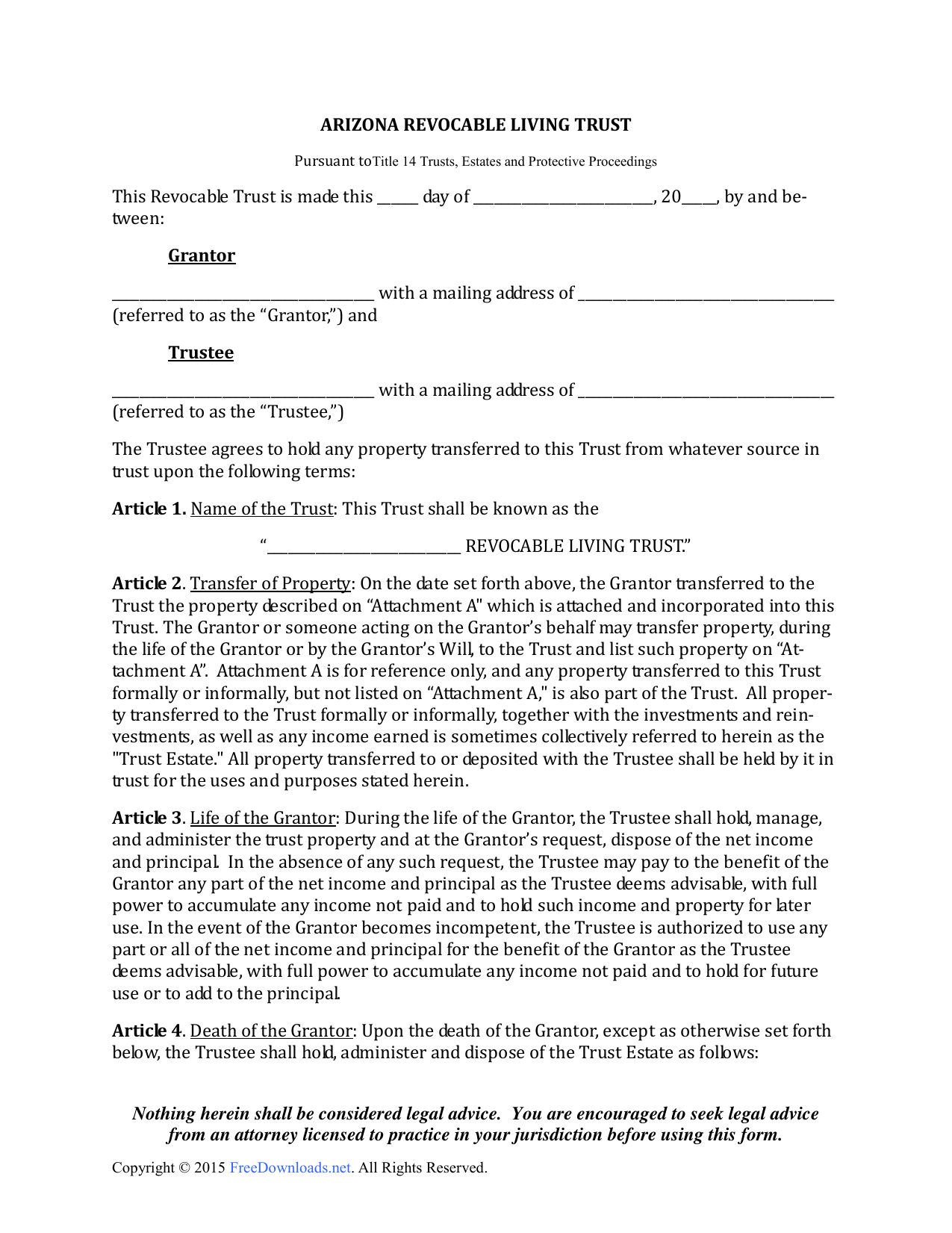

To learn more about revocable trusts go here when talking about trusts the term living means that the trust goes into effect during the grantor s life. A revocable living trust allows you to change or cancel the trust at any point during your life while an irrevocable living trust becomes permanent. The arizona living trust is a document that allows a person to place personal property and or real estate in a holding the enables the beneficiary ies to bypass the probate process after the trust creator s death. If you are at risk for either of these usually entrepreneurs whose personal credit and liability are tied to their business an irrevocable trust may be a better solution since assets in an irrevocable trust are separate from your personal estate.

This sets them apart from revocable trusts which can be terminated at least until they become irrevocable at the death of the trust maker the grantor. The arizona revocable living trust is a document created by an individual who wishes to protect their assets and leave instructions for an appointed trustee to distribute assets to beneficiaries when they die. Ownership of the assets are transferred to the trust but the. Arizona revocable living trust form.

Per state law they must be informed by the trustee within 60 days that a trust has moved from revocable to irrevocable. Legal expectations of trust beneficiaries.