Lease Vs Purchase Equipment Calculator

On the other a lease has lower monthly.

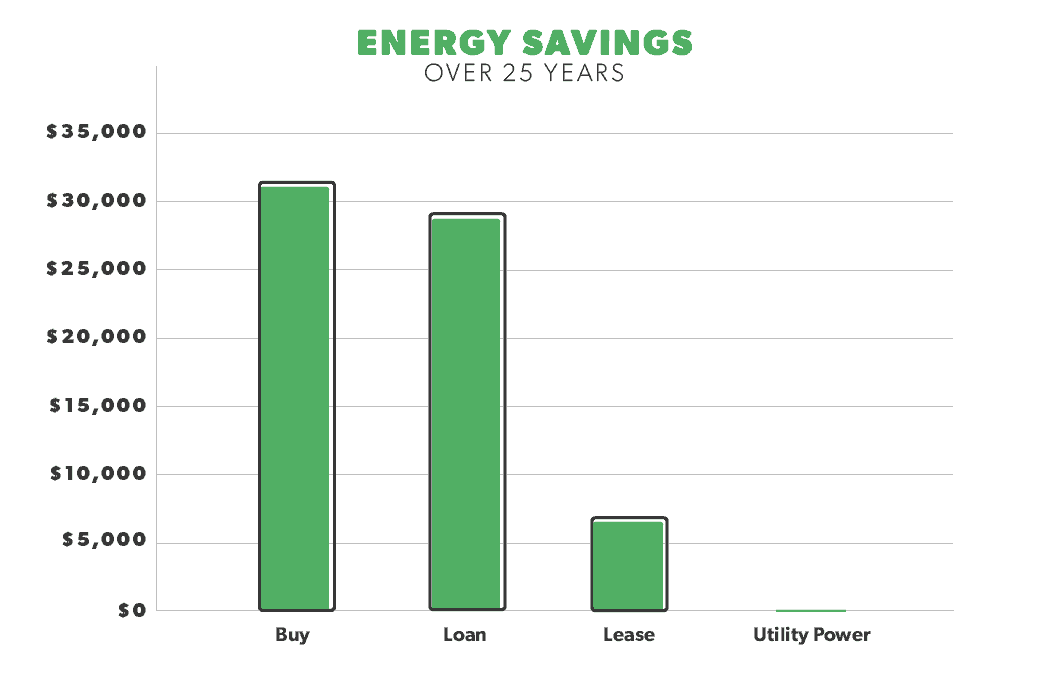

Lease vs purchase equipment calculator. The buy vs lease calculator will automatically calculate the data based on provided information. On one hand buying involves higher monthly costs but you own something in the end. The choice between buying and leasing has often been a tough call. By comparing these amounts you can determine which is the better value for you.

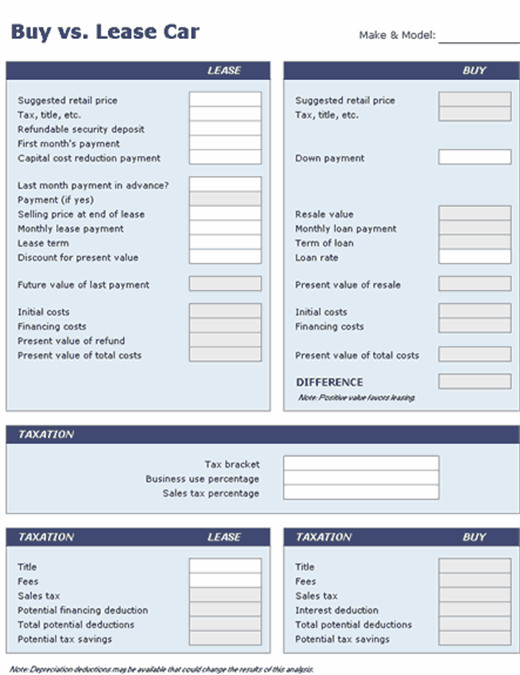

Calculate the savings on your next car lease or new car purchase. Buying used vs leasing new. Equipment buy or lease calculator. That said you could enter the lease payment of a new vehicle and the purchase price of a used one in this calculator.

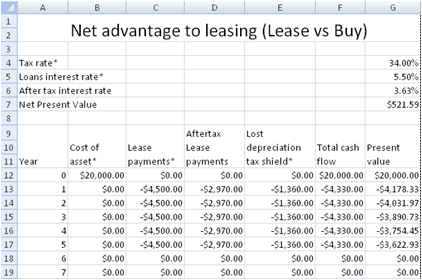

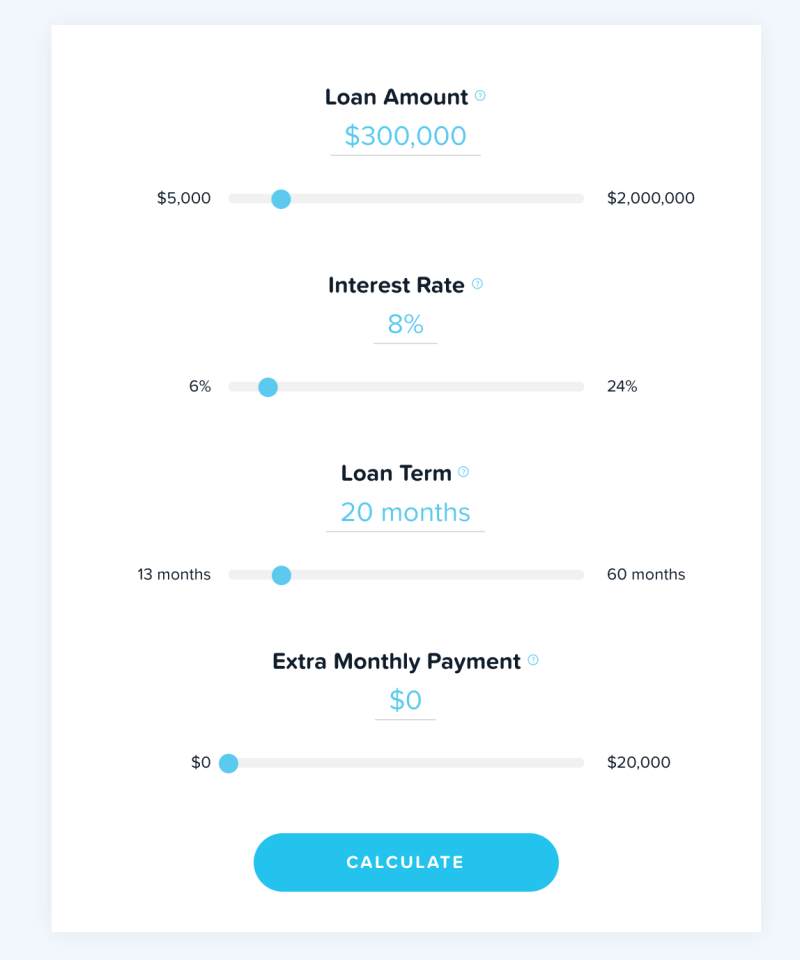

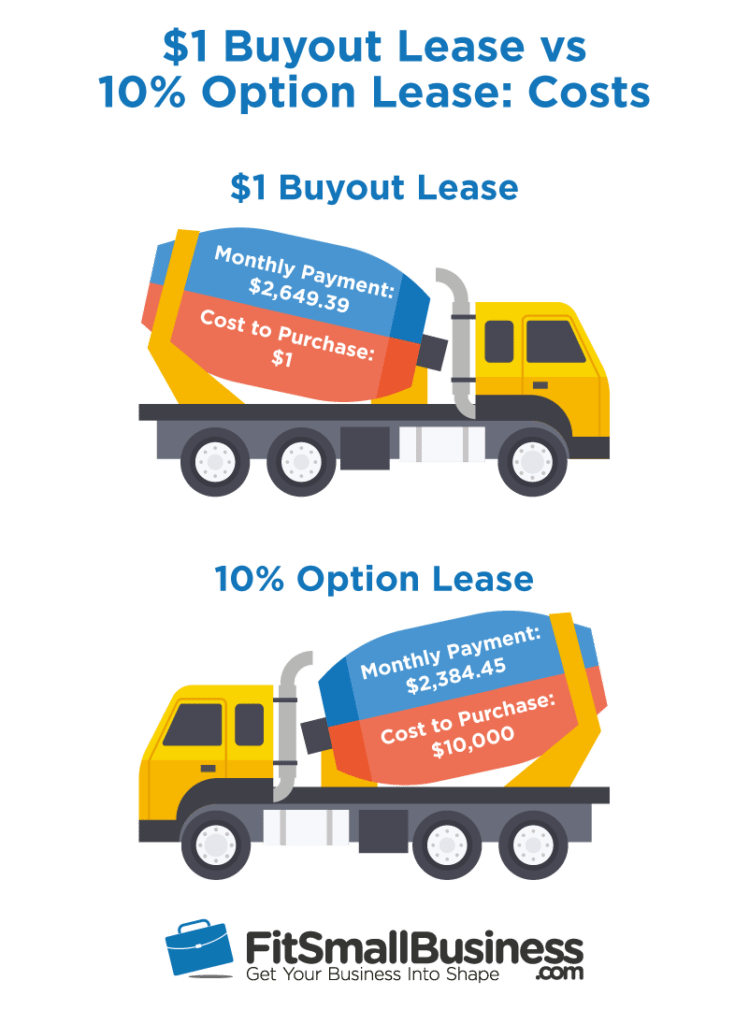

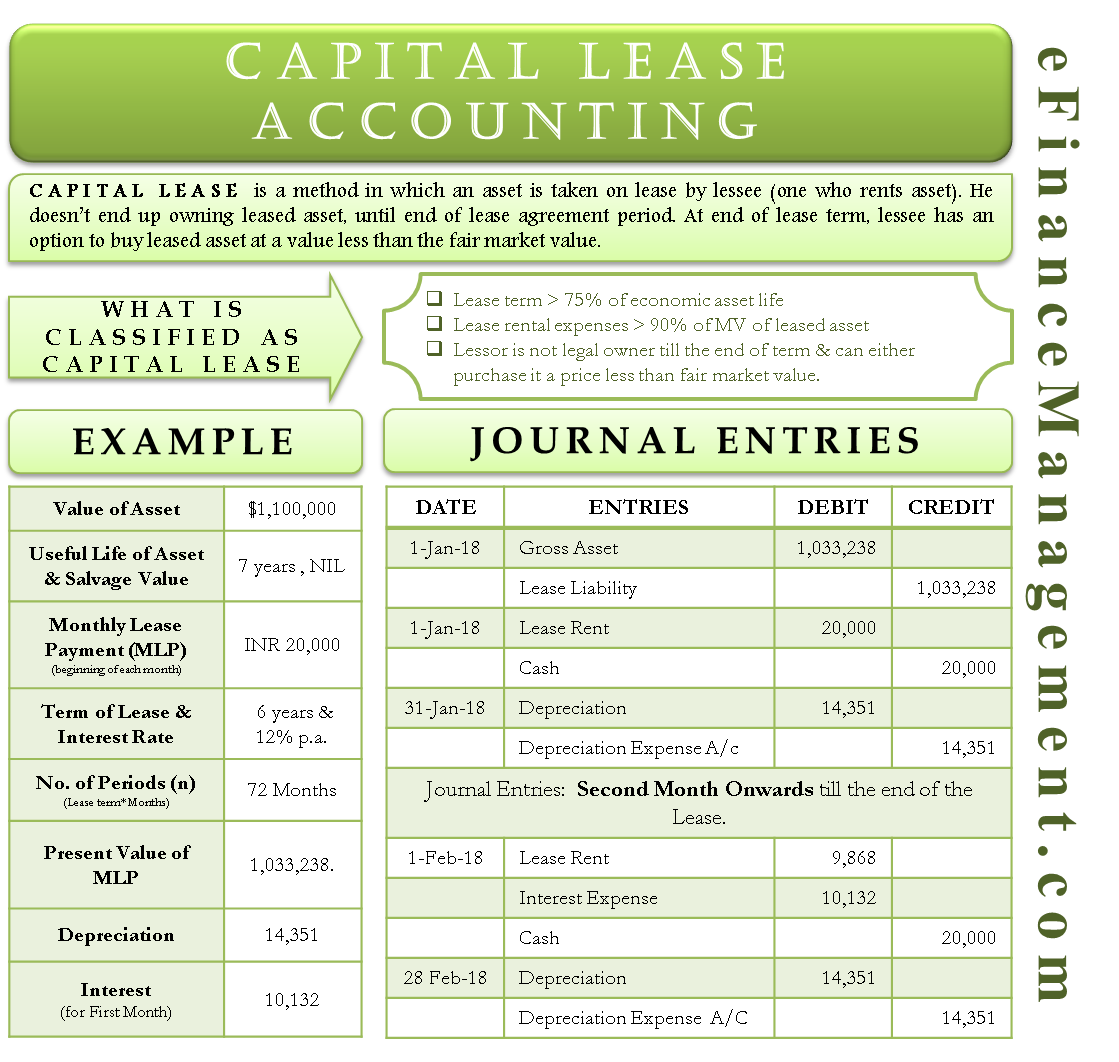

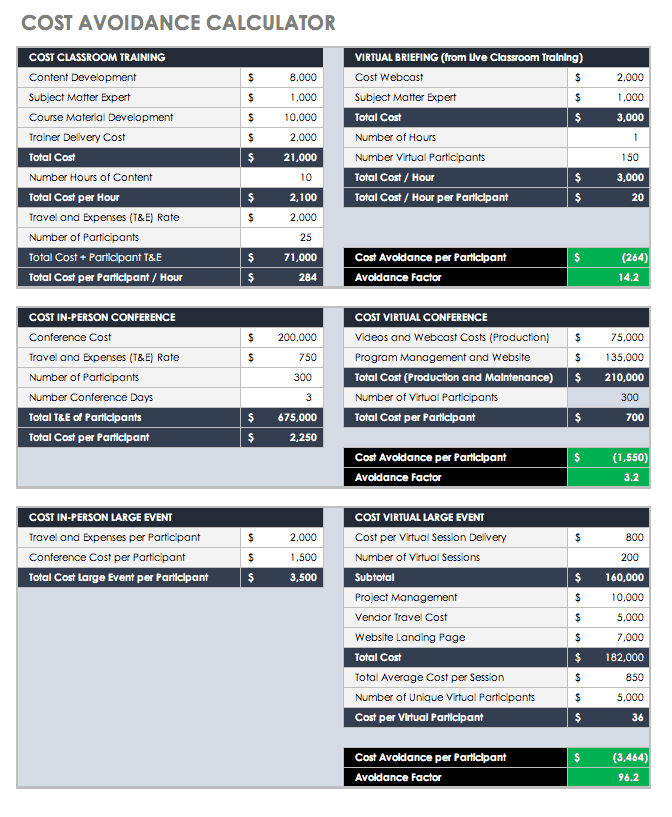

Leasing equipment is sometimes an attractive alternative in part because of tax benefits and in part because you might be able to pay lower monthly payments than you would with a purchase loan. The 10 purchase lease which is a combination of an operating and capital lease. Beyond simply weighing the overall costs of buying or leasing a piece of equipment you also need to consider maintenance tax deductions flexibility and more. Keybank s equipment buy or lease calculator helps you solve the dilemma by comparing the two options and finding the best value.

Equipment buy or lease calculator deciding whether to buy or lease equipment is an important decision for your small business. Use our lease vs buy calculator to help make your business equipment decisions should i lease or buy equipment. Use this calculator to find out. You can analyze the leasing vs buying a car pros and cons by looking through the calculation result.

For business owners who need certain equipment like computers machinery or vehicles to operate there is a lot to consider. Leasing is a popular method of acquiring new equipment for your business. Because the taxation is not included in comparing result you may need to consider the tax and maintenance too. Since you cannot lease a used car it s more difficult to compare leasing new vs buying used.

Should you lease or buy. Although the payments may seem attractive it may not always be the best financial decision versus purchasing the equipment outright and financing it with a low. We calculate monthly payments and your total net cost.